While not overly complicated, if you aren’t recording your transactions properly you may create more work for yourself and your accountant come 990 time.

If you engage in fundraising programs, receive contributions of personal property, securities or other assets, or engage in auctions or other special events to raise funds, there is a good chance you are reporting them incorrectly on your 990 or 990EZ.

So how do you report contributions on your organization's tax return? For purposes of this blog I am referencing form 990EZ as this is the return filed by most small nonprofits.

If you receive monetary contributions directly from donors, the rules are relatively simple. You have to report the total you receive on Line 1 of Form 990EZ. Keep in mind however, if you receive more than $5,000 from any one "person" during the year, you may have to file Schedule B with your Form 990EZ. The IRS defines a “person” as an individual, fiduciary, partnership, corporation, association, trust, and other tax-exempt organization.

Here's where it gets tricky. Small nonprofits often neglect to show the value of property contributed to your club. When someone contributes property to your organization, the rules are basically the same as above. You use the fair market value of the contributed property for purposes of recording the contribution on line 1, and to determine whether the contributor must be listed on Schedule B.

And here's where carefully recording your transactions in Treasurer's Briefcase will save you headaches. Special events are activities that incidentally accomplish an exempt purpose by providing funds for your organization. They include dinners, dances, raffles, bingo games, and auctions. The IRS asks you to separate these activities between - contributions, gross proceeds, event costs and fundraising expenses.

In essence you must report the true fair value of the event (dinner) as gross proceeds on Line 6b of form 990EZ. The ticket price in excess of the fair value is a contribution and should be reported on Line 1 and in the parentheses on Line 6b. The actual costs of the event, such as food, decorations and entertainment, are the event expenses which you show on Line 6c. Costs of soliciting ticket sales, such as mailings, are fundraising expenses, also shown on line 6c of 990EZ. Form 990 requires these expenses to be reported separately.

Auctions present the most confusing reporting dilemma for small nonprofits. The initial contribution of the property is reported at its fair value on Line 1 as a contribution. Later when an auction is held and the property is sold the fair value at the time of the sale is reported on line 6b while the value at the time it was donated is reported on line 6c. For most small nonprofits this will be the same amount, however there may be situations in which the value rises. Often the winner of the auction bids greater than fair value for the item. This excess value must be reported on line 1.

Luckily your job as Treasurer is to gather the information and report it to your members and Treasurer's Briefcase can make this job much easier. Members can also rely on our tax professionals to help sort out the 990 reporting rules. Knowing the basics of these rules up front should make recording your transactions and filing the tax return much easier for your organization.

The Groveville Gorillas baseball team hosted a beef and beer to raise funds for their trip to the State tournament. A beef dinner and pitcher of beer at the tavern sells for $20. The club sells 200 tickets to the event at $35 per ticket. The tavern charges $10 per person to the league.

Scotty Smalls donates his baseball signed by Babe Ruth (The Bambino) to the team for the auction. The fair value of the ball is $350, but it is auctioned for $600.

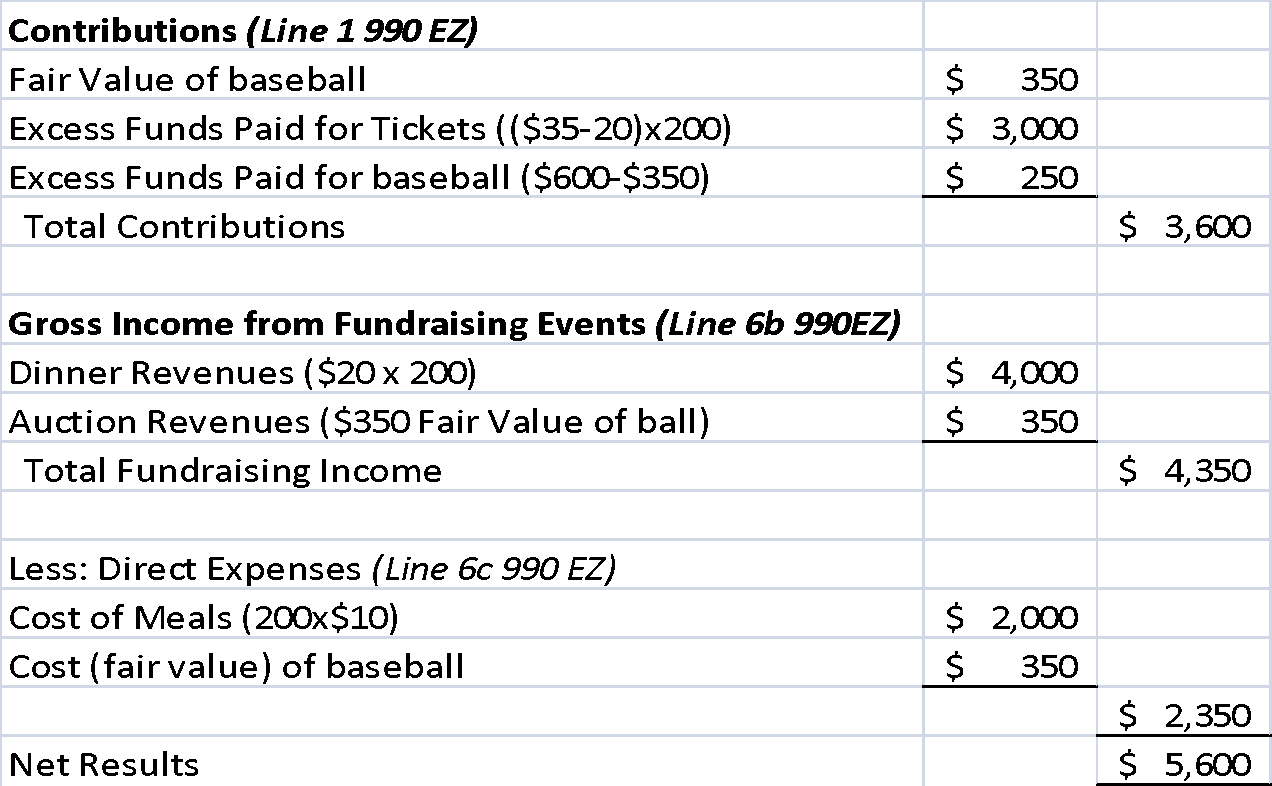

Here’s how this information should be reported.

Cash Contributions

If you receive monetary contributions directly from donors, the rules are relatively simple. You have to report the total you receive on Line 1 of Form 990EZ. Keep in mind however, if you receive more than $5,000 from any one "person" during the year, you may have to file Schedule B with your Form 990EZ. The IRS defines a “person” as an individual, fiduciary, partnership, corporation, association, trust, and other tax-exempt organization.

Property Contributions

Here's where it gets tricky. Small nonprofits often neglect to show the value of property contributed to your club. When someone contributes property to your organization, the rules are basically the same as above. You use the fair market value of the contributed property for purposes of recording the contribution on line 1, and to determine whether the contributor must be listed on Schedule B.

Special Events and Auctions

And here's where carefully recording your transactions in Treasurer's Briefcase will save you headaches. Special events are activities that incidentally accomplish an exempt purpose by providing funds for your organization. They include dinners, dances, raffles, bingo games, and auctions. The IRS asks you to separate these activities between - contributions, gross proceeds, event costs and fundraising expenses.

In essence you must report the true fair value of the event (dinner) as gross proceeds on Line 6b of form 990EZ. The ticket price in excess of the fair value is a contribution and should be reported on Line 1 and in the parentheses on Line 6b. The actual costs of the event, such as food, decorations and entertainment, are the event expenses which you show on Line 6c. Costs of soliciting ticket sales, such as mailings, are fundraising expenses, also shown on line 6c of 990EZ. Form 990 requires these expenses to be reported separately.

Auctions present the most confusing reporting dilemma for small nonprofits. The initial contribution of the property is reported at its fair value on Line 1 as a contribution. Later when an auction is held and the property is sold the fair value at the time of the sale is reported on line 6b while the value at the time it was donated is reported on line 6c. For most small nonprofits this will be the same amount, however there may be situations in which the value rises. Often the winner of the auction bids greater than fair value for the item. This excess value must be reported on line 1.

Luckily your job as Treasurer is to gather the information and report it to your members and Treasurer's Briefcase can make this job much easier. Members can also rely on our tax professionals to help sort out the 990 reporting rules. Knowing the basics of these rules up front should make recording your transactions and filing the tax return much easier for your organization.

An Example

The Groveville Gorillas baseball team hosted a beef and beer to raise funds for their trip to the State tournament. A beef dinner and pitcher of beer at the tavern sells for $20. The club sells 200 tickets to the event at $35 per ticket. The tavern charges $10 per person to the league.

Scotty Smalls donates his baseball signed by Babe Ruth (The Bambino) to the team for the auction. The fair value of the ball is $350, but it is auctioned for $600.

Here’s how this information should be reported.

In Treasurer's Briefcase, you should split the revenue when you record it between the two categories Contributions, Gifts & Grants and Fundraising, apportioning the value above the fair market value as a contribution and the rest as Fundraising.

If you've followed these rules, at the end of the year your Treasurer's Report will provide all of the information you or your accountant should need to file your 990!

No comments:

Post a Comment

All messages are moderated for appropriateness and relevance